Credit Risk

Navigate counterparty credit risk with confidence

Evaluate financial health, performance, and trends before making informed investment decisions

Your chosen financial data sources

Your internal insights & expertise

Your bespoke scoring methodology

Your own secure & centralized platform

Building upon the powerful Aerlytix technology suite, Credit Risk is a comprehensive risk management platform driven by your proprietary credit scoring methodologies and enriched by intelligence sources chosen by you. The platform offers the scale and scope to complete deep credit risk analysis and evaluations of your global counterparties, all within one interface.

Risk Knowledge Base

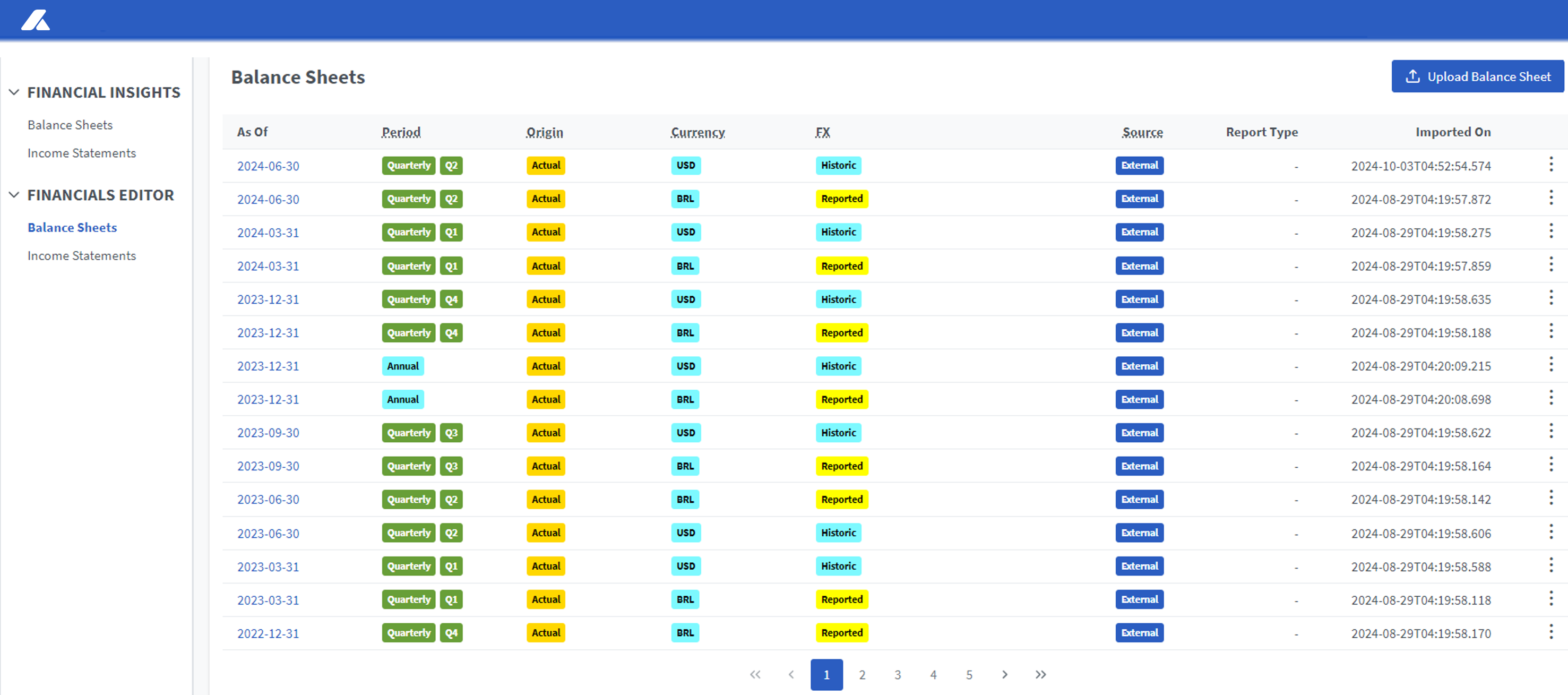

The Credit Risk Knowledge Base gives Risk Managers a centralized location to store all qualitative and quantitative risk-relevant information. This data can be uploaded directly from internal sources or seamlessly integrated with third-party sources, such as Airfinance Global.

Non-financial counterparty attributes can also be added to build a comprehensive risk profile.

Your Scoring Methodology

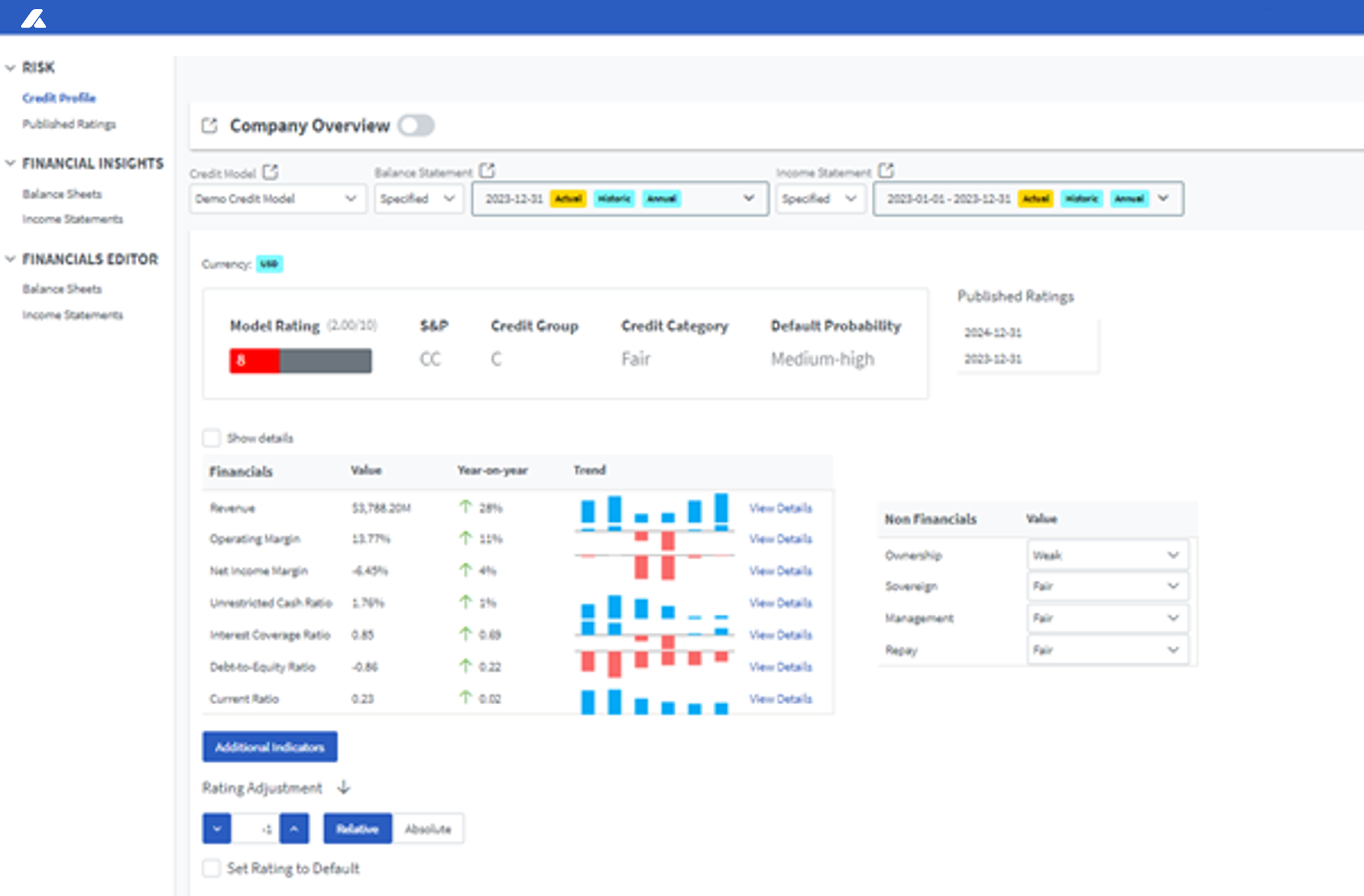

Proprietary risk methodologies defined by you are applied to your data with flexibility to adjust and customize based on your specific needs and insights.

Advanced calculation models are automated based on your unique inputs, giving you your own credit profiles and risk ratings, published within our centralized platform for further analysis. Detailed dashboarding and exception-based reporting is available as standard.

Integration with the Aerlytix Analytics Suite

Credit Risk is available standalone or seamlessly integrated into the Aerlytix Analytics Suite.

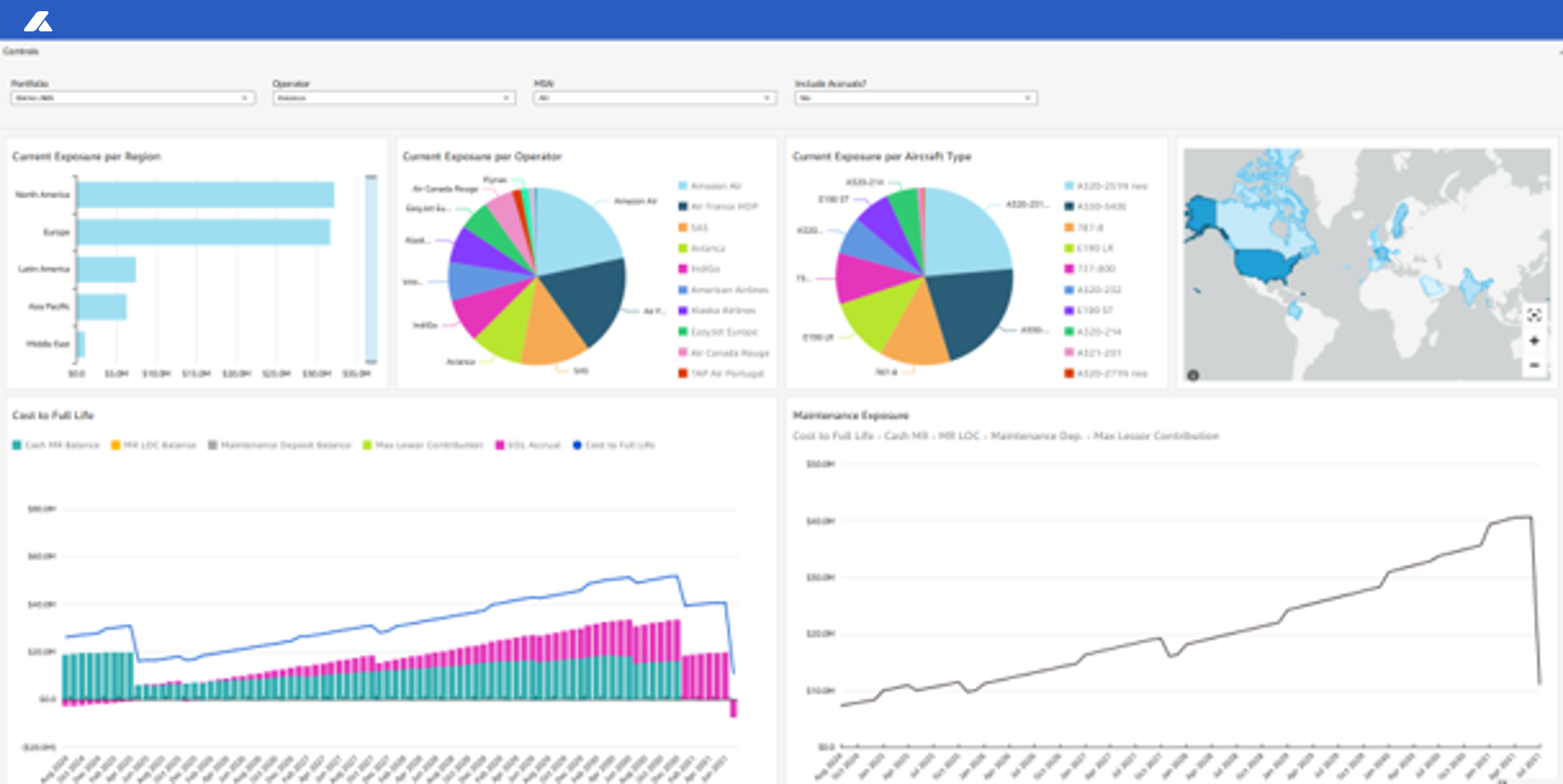

Aerlytix Analytics Suite users can run enhanced reporting on a credit adjusted basis, including Aircraft Recovery Model Forecasts and Lessee Default models.

Portfolio-Level Exposure Analytics can also be gained through the seamless integration of the Credit Risk Module with industry-leading maintenance cashflow and valuations analytics.

In Partnership with Airfinance Global

Aerlytix partners with Airfinance Global to automatically import global financial and operational data into your Credit Risk knowledge hub, enhancing credit scoring and risk rating analysis within a single centralized platform.

Complete control over your rating system – define, adjust and refine over time

Flexibility to tailor credit risk assessments with custom-defined credit scoring

Centralized and intuitive data storage for financial and non-financial information

Comprehensive view of counterparty credit and risk profiles globally

Exception-based reporting enabling proactive monitoring of emerging exposures

Secure and scalable web-based solution with approval workflows and audit trail

Request a Demo of Credit Risk

Transform how credit processes are completed while centralizing outputs for a more comprehensive assessment. Get in touch today to learn more.